Charity Shops Embrace Online Sales to Compete with Second-Hand Apps

In a bid to stay competitive against second-hand clothing applications, an increasing number of charity shops are turning to online sales.

Store operators attribute the decline in in-store profitability for 2024 to rising staffing expenses and a reduction in the quality of donated clothing, primarily due to fast-fashion retailers.

Analysis from the Charity Retail Association (CRA) indicates that from April to December, in-store revenue fell short compared to the same period the previous year. However, online sales experienced growth exceeding 10 percent in each quarter of the last year, with 75 percent of the latest survey participants having moved their operations online.

Robin Osterley, the chief executive of the CRA, remarked, “These are undeniably challenging times for charity retailers. The rise in the national living wage, which we support, is painful, and the increase in national insurance contributions will have significant implications.”

He noted that there are currently 26,000 paid employees within the sector, alongside 186,000 volunteers, a figure that is significantly lower than the pre-pandemic count of 220,000.

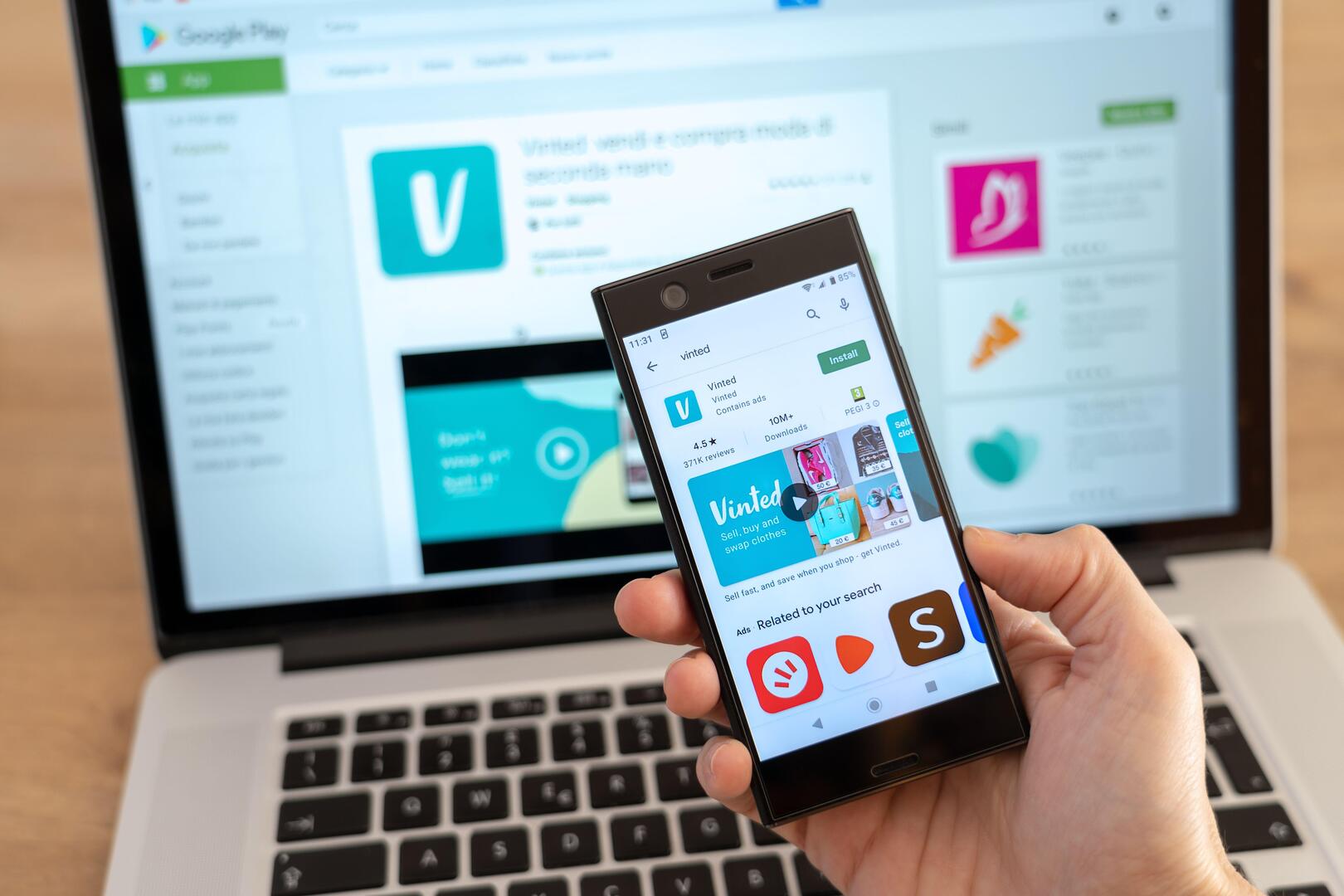

Osterley expressed concerns about the diminishing quality of donations over the last couple of years, speculating whether this trend is influenced by the presence of online platforms like Vinted. He suspects that individuals might now separate their donations into two bags: one for the charity shop and another for online resale.

Many charity organizations have started utilizing online marketplaces to showcase valuable items and unique finds from their donations, according to Osterley.

The British Heart Foundation (BHF) leads the way in online charity sales on eBay, having sold 2.5 million items with nearly 330,000 followers. The charity is also expanding its reach on Depop, which has a following of 23,000, and sells medical equipment, including defibrillators and blood-pressure monitors, through its e-commerce platform.

Mike Taylor, the foundation’s commercial director, mentioned that the number of physical locations has remained steady at 680 over the past three years, contributing about 15 to 20 percent to its annual fundraising efforts.

“BHF retail experienced strong profits in the years following the pandemic,” he stated. “However, in 2024, like many high street clothing and non-food retailers, we face tougher trading conditions, leading us to anticipate a decline in our profits this year due to the wider challenges in the retail market.”

In reaction to the high street’s struggles, Taylor highlighted that the BHF sells over 500,000 donated items online annually, with most listed and sold directly from their physical shops. Their Depop account has also emerged as one of the platform’s top sellers.

Oxfam has adopted similar strategies; a representative shared that while retail sales have remained “relatively steady,” escalating utility costs present “significant challenges for charities.” Additionally, they noted the increasing competition within the second-hand clothing market.

Despite these hurdles, Oxfam’s online shop generated over £10 million in income during the last fiscal year. The charity was among the first to establish a presence on Vinted, which provides special Pro status to registered charities and enables them to incorporate donations into their product pricing.

Steve Dool, senior brand director at Depop, reported a rise in charity sector participation on their platform during the pandemic years of 2020 and 2021. Depop serves as an avenue for charities to clear out surplus inventory they may not have the physical retail space to sell or as an additional sales channel that attracts buyers beyond their local areas.

“We’ve observed that established charities on Depop enjoy high rates of repeat purchases, with customers actively returning to shop from those charity profiles,” he explained.

Osterley commented on the role of online marketplaces, stating, “We have no objections to these platforms… Many of our members benefit significantly from sales driven by people purchasing items to resell. We are quite content to coexist within the same ecosystem.”

Post Comment