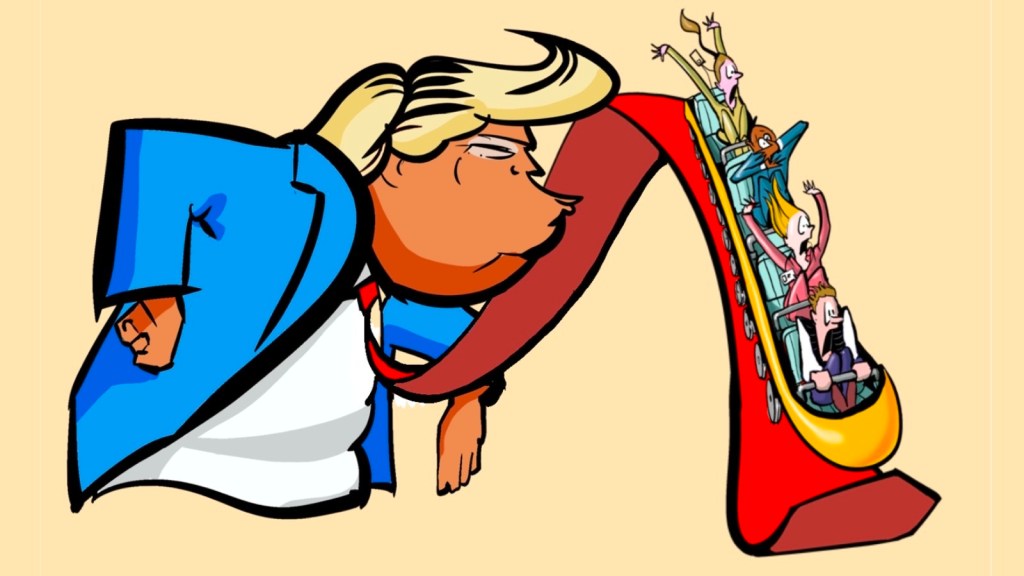

The Turbulent Week Navigating Trump’s Tariffs

Harvey Bradley has a reliable morning routine. On workdays, he typically waits for the 6:54 AM train at the railway station in the quaint Berkshire village of Twyford, heading to London Paddington before continuing to his office in the City.

However, on Monday, he had to alter his plans, arriving at the station in time for a train around 5:40 AM to get to his position at Insight Investment, one of the largest bond investors in London. The dramatic announcement of Donald Trump’s so-called “liberation day” the previous Wednesday, April 2, had been anticipated, but the magnitude of the proposed protectionist measures surprised even the most pessimistic investors.

What initially appeared to be a controlled reaction from global stock markets rapidly escalated into chaos throughout the week. The situation reached a critical point on Friday, April 4, when the FTSE 100 index dropped by 5 percent, leaving Bradley and others in the financial sector anxiously awaiting the following Monday.

“When I wake up, I check the movements in the Asian markets,” Bradley shared. His concerns were validated as he observed stock markets plummeting further. Knowing he faced a “challenging week,” he prepared for the tumult ahead.

This week would go down in history as one of the most volatile periods for financial markets, during which the U.S. president faced mounting pressure from bond traders, needing to avert a crisis reminiscent of the Liz Truss era.

Some analysts have even suggested that the markets are currently experiencing what could be termed the Great Tariff Crisis, akin to the Great Financial Crisis of 2008.

The unfolding events of the week began with significant losses.

Asian Market Collapse

Upon arriving at his office, Bradley was met with alarming headlines: fears of a trade war sent the Hang Seng index in Hong Kong plummeting by 13 percent—its steepest decline since the 1997 Asian financial crisis. The Shanghai composite index fell by 7.3 percent, while Taiwan recorded its largest one-day drop at 10 percent.

“The atmosphere at our desk was more animated than usual,” Bradley noted, as he and his coworkers reacted to the data streaming on their screens.

Meanwhile, Dominic Gauld, a trader at Peel Hunt investment bank, braced for an intense day ahead. He believed that Friday’s steep decline stemmed from a “buyers’ strike,” where traders opted not to purchase stocks that would normally entice them, rather than excessive selling pressure.

The mood shifted on Monday morning: “There was increased volatility and panic—early selling was evident,” Gauld recounted. The FTSE 100 index plunged by 6 percent right at the start, marking a one-year low with all stocks experiencing losses.

An hour later, Johanna Kyrklund was leading her standard morning meeting at Schroders, an asset manager with approximately £780 billion in investments, where up to 600 participants can join remotely.

The chief investment officer of Schroders had spent her weekend walking her whippet, Luna, along the Thames Path, where she encountered numerous dog walkers discussing recent market upheavals.

“I ran into several individuals who expressed concern, asking, ‘How are you managing? Are you feeling stressed?’” she recounted. “But I wasn’t stressed. This is always a complex environment, and we continue to be vigilant about market conditions.”

While the start of the week felt like any typical Monday, there was quite a bit to discuss during their morning meeting. “On many Mondays, there’s not much to cover. Suddenly, there’s a significant topic that necessitates everyone’s input,” Kyrklund explained, highlighting the value of collective knowledge during turbulent times.

“Our team members have decades of experience, having navigated previous challenges such as the tech bubble, financial crisis, pandemic, and geopolitical issues,” she said. “While I feel emotionally stable, the complexity of the situation cannot be understated.”

Others had to cut their weekends short. Isabelle Mateos y Lago, BNP Paribas’s chief economist, typically drives to Paris on Monday mornings, but opted to take the Eurostar on Sunday night to be fully prepared for the upcoming challenges. “It was a wise choice,” she reflected.

From an economic perspective, she focused on potential impacts on growth: “Everyone globally will feel the effects, but Europe has the best capacity to manage this shock thanks to its large internal market and room for supportive policies.”

In New York, Wall Street began the week mirroring its previous week’s downward trend, with losses exceeding 3 percent across the S&P 500, Dow Jones, and Nasdaq.

False Reports

Then, at approximately 3:15 PM London time, a sudden shift occurred when James Smith, a market economist at ING, observed a surprising recovery as the Dow Jones index surged by 1.4 percent. “It was astonishing—everyone was scrambling for the source of the upturn,” Smith recalled, as trillions of dollars changed hands globally.

The cause for this spike became apparent: a report that Trump was contemplating a 90-day pause on tariffs was quickly labeled as “fake news” by the White House.

The suggestion of a pause had circulated since a Sunday call from hedge fund billionaire and Trump supporter Bill Ackman, who urged for a “90-day timeout” to prevent an “economic nuclear winter”. When White House economic adviser Kevin Hassett was questioned about this on Monday, he responded, “The president will decide his course of action.”

This miscommunication led to a temporary rise in the Dow of 800 points after it had been down by 1,700. But soon after, Wall Street began retreating, closing with the Dow down by 0.9 percent and the S&P by 0.2 percent, while the Nasdaq managed a slight gain of 0.1 percent.

The more stable end to trading in New York allowed Asian equity markets to regain composure, while the FTSE 100 opened higher on Tuesday.

This rollercoaster for equity investors was mirrored by the Vix index, reflecting heightened expectations of future trading volatility, reaching levels unseen since the Covid-19 lockdowns of 2020 and the 2008 financial crisis.

Concern escalated in the bond markets. On Tuesday morning, Bradley observed unusual swings in the pricing of Japanese government bonds, typically considered a stable investment. Simultaneously, the $29 trillion U.S. Treasury market began to behave erratically.

Ordinarily, investors flock to U.S. Treasuries during crises, viewing them as safe havens compared to equities or corporate bonds. However, instead of declines in yields—indicative of increased demand—yields surged sharply.

This conflicting information pointed to a deeper systemic crisis in global markets, suggesting issues within the financial infrastructure that typically occur during significant economic downturns.

Prompted by these market dynamics, one bond trader speculated that the White House would be compelled to intervene: “As the market struggles, it seems inevitable that Trump will have to retract some policies.”

With the turmoil continuing, some firms attempted to project normalcy on Wednesday. Baker Tilly’s UK branch surprised many in the City by announcing its plan to proceed with a stock market listing, with trading expected to commence on Tuesday.

Nonetheless, most believed the ongoing upheaval would result in deal cancellations and a slowdown in new listings in London, as described by a private equity executive who mentioned that negotiations were being abandoned altogether. “People are stepping away from deals—they prefer to avoid looking foolish,” he asserted.

Tariff Pause Announced

All eyes turned to the bond markets, factored by rumors suggesting the U.S. Federal Reserve might need to step in to stabilize Treasury yields. Traders speculated that hedge funds were in the process of unwinding their “basis trades,” transactions traditionally valued around $1 trillion, representing a strategy to earn on tiny price discrepancies in these bonds.

Consequently, conversations began about the potential “Trump put”—the moment when the president would determine the market had dropped too steeply and reconsider his protectionist strategy. Shortly after trading commenced in the U.S., Trump posted on Truth Social, declaring: “THIS IS A GREAT TIME TO BUY!!!”

This remark sparked significant concern among seasoned hedge fund investors in Mayfair, with one stating, “Had I done anything resembling this, I would face severe consequences.”

Less than four hours after posting, Trump announced a 90-day halt on retaliatory tariffs, although the overarching 10 percent rate remained intact.

This announcement reignited Wall Street. Though London’s markets had already closed for almost two hours, Mateo y Lago was en route back from Paris when she received alerts about Trump’s decision.

“I was next to a lady from Singapore, and we were both receiving the same alerts. She provided insightful context about the Asian market’s reaction to the unfolding news,” said Mateos y Lago as she began to message her colleagues.

Gauld from Peel Hunt noticed a sharp shift in Wall Street as he left work that day. “This illustrates how sensitive the market is—it wants to recover, and will capitalize on any opportunity to rally, and it has,” he stated.

By the close, the S&P 500 had surged by 9.5 percent—marking the largest single-day rally since 2008—with the tech-driven Nasdaq increasing by 12 percent. A record 30 billion shares changed hands on U.S. exchanges.

However, not all were celebrating.

A hedge fund manager with short positions, profiting when stock prices decrease, confessed, “I felt a bit disappointed—not from a global standpoint but from a fund perspective—as I had anticipated a crash.”

After the electrifying close on Wall Street, Gauld entered work on Thursday morning anticipating a positive opening for the London stock exchange.

The FTSE opened strong, benefiting from expectations that a drop in bookings had been circumvented, with British Airways’ parent company IAG rising over 20 percent at one point, though those gains were reduced later. Ultimately, the FTSE ended the day 3 percent higher.

Back in London, Mateos y Lago considered the economic implications of Trump’s 90-day pause, including the reality that tariffs on China had now escalated to a staggering 125 percent.

“These exorbitant tariffs will significantly impact the American households—this represents the largest tax increase in decades, costing nearly $5,000 per family,” she noted.

“The repercussions of this adjustment will be enduring,” she emphasized.

Wall Street seemed to echo her sentiments, as after the substantial 9.5 percent rally, the S&P subsequently dropped by 3.5 percent.

Regarding the critical bond yields? After Wednesday exhibited the most significant yield spike in two-year Treasuries since 2009, they briefly fell but began to rise again on Thursday.

Declining Confidence

The FTSE experienced a steady opening on Friday, buoyed by data indicating a better-than-expected economic growth of 0.5 percent in February, managing to maintain gains even as China announced the increase in tariffs on American products from 84 to 125 percent.

As Gauld returned home for the weekend, he noted that while the markets appeared to be “calm,” the dollar had hit a three-year low while gold prices soared to record heights. Bradley, at Insight, remarked that Treasury yields were back at the levels they were before Trump implemented his 90-day tariff freeze.

“Global investors seem to be losing trust in the stability and safety of U.S. assets. Traditionally, uncertainty leads investors to U.S. Treasuries and dollars, but if the origin of volatility lies with the U.S. government, then alternatives are sought,” Bradley stated, pointing to a noticeable shift toward European bonds.

Despite yields on 30-year Treasuries being higher than when the week began, the volatility persisted, illustrated by a 2 percent jump in the S&P for its most significant weekly increase since 2023.

As speculation continues, many are left pondering Trump’s next moves.

Even on Saturday, Trump appeared to introduce a significant concession to Apple concerning exemptions from his punitive tariffs on specific electronic items.

“Every crisis has its unique characteristics, but I have been preparing in terms of game theory, contemplating the multifaceted nature of these interactions. It’s akin to managing 100 simultaneous games of strategy,” Kyrklund from Schroders reflected.

As for Bradley, will he continue to wake up earlier? “I suspect so—for the foreseeable future,” he affirmed.

Post Comment